Another Sad Tale Caused by a Preprinted Will Form

- By lemaster

- •

- 11 Jul, 2016

If the recent decision handed down by the Florida Supreme Court in Aldrich vs. Basile isn't enough to dissuade you from making your own Last Will and Testament, then I don't know what will convince you not to do it. Here are the facts of the case:

- In April 2004, Ann Dunn Aldrich used an "E-Z Legal Form" to make her Last Will and Testament. In Article III of the form entitled "Bequests," just after the form's pre-printed language directing payment of debts, Ms. Aldrich hand wrote instructions stating that all of her "possessions listed" go to her sister, Mary Jane Eaton - this included Ms. Aldrich's house, contents, and lot; a Fidelity Rollover IRA; a United Defense Life Insurance policy; an automobile; and bank accounts.

- Ms. Aldrich also wrote that if her sister died before she did, then she left all listed property to her brother, James Michael Aldrich.

- The will contained no other provisions.

- Ms. Aldrich signed the will in front of two witnesses on April 5, 2004.

- Mary Jane Eaton died on November 10, 2007. As a result, Ms. Aldrich inherited her sister's real estate located in Putnam County, Florida, along with some cash which Ms. Aldrich deposited into a new Fidelity account that she opened in July 2008.

- In November 2008, on a sheet of paper with the pre-printed title "Just a Note," Ms. Aldrich hand wrote the following: "This is an addendum to my will dated April 5, 2004. Since my sister Mary jean Eaton has passed away, I reiterate that all my worldly possessions pass to my brother James Michael Aldrich, 2250 S. Palmetto, S. Dayton FL 32119. With her agreement I name Sheila Aldrich Schuh, my niece, as my personal representative, and have assigned certain bank accounts to her to be transferred on my death for use as she seems [sic] fit." The "addendum" was dated November 18, 2008 and contained the signatures of Ms. Aldrich and Ms. Schuh, who is the daughter of James Michael Aldrich.

- Ms. Aldrich died on October 9, 2009.

So, from these facts it appears that James Michael Aldrich should have inherited Ms. Aldrich's entire estate, right? Wrong, because, in attempting to write her own will and then a codicil, Ms. Aldrich's do it yourself documents failed miserably. Why? For two reasons:

- First and foremost, the will failed to dispose of all of Ms. Aldrich's property since it didn't include a "residuary clause" which would have addressed what should happen to any property Ms. Aldrich owned which was not included in her "possessions listed" as well as property Ms. Aldrich acquired after the date she signed the document.

- And, just as problematic, Ms. Aldrich's attempted codicil to address the property she inherited from her sister after she signed the will failed because she didn't sign it with the proper formalities required by the Florida Probate Code - under Florida law, wills and codicils must be signed in the presence of two witnesses; the "addendum" only included the signature of one witness.

So who inherited the real estate located in Putnam County and the Fidelity account, in other words, the property that Ms. Aldrich inherited from her sister which was not listed in Ms. Aldrich's will? Enter Laurie Basile and Leanne Krajewski, two nieces of Ms. Aldrich who were the children of a predeceased brother. They intervened in the probate administration, claiming that since Ms. Aldrich's will didn't contain a "residuary clause" and the November 2008 "addendum" didn't legally qualify as a codicil under Florida law, then they should share in the distribution of the Putnam County real estate and the new Fidelity account as intestate heirs. While the lower court sided with Mr. Aldrich, who thought that he should inherit Ms. Aldrich's entire estate (which appeared to her intent, didn't it?), this case made it all the way up to the Florida Supreme Court, which sided with Ms. Basile and Ms. Krajewski.

Now as I said at the beginning, if this case isn't enough to convince you not to write your own Last Will and Testament, then I don't know what will. And by the way, E-Z Legal Forms has a website where you can apparently purchase a pre-printed Last Will and Testament Form for only $2.95 - what a bargain!

The lessons learned from the Aldrich case have been summed up nicely by Justice Pariente, who wrote in his concurring opinion, "I therefore take this opportunity to highlight a cautionary tale of the potential dangers of utilizing pre-printed forms and drafting a will without legal assistance. As this case illustrates, that decision can ultimately result in the frustration of the testator's intent, in addition to payment of extensive attorney's fees - the precise results the testator sought to avoid in the first place." Amen.

May I repeat: "You can pay in the front, or pay in the back. The back is more expensive."

Brought to you as a service of AJ Mannion Law Office LLC

The federal

Equal Employment Opportunity Commission (EEOC) released its employment

discrimination report for 2016. Overall, the commission collected $482 million

for victims of discrimination in private, federal, state, and local government

workplaces. Private-sector employers paid over $347.9 million to victims of

employment discrimination.

The top 10 employment charges, as listed by the EEOC in 2016, provide some real life lessons. Leading the way were retaliation, 42,018, about 46% of all charges filed, race 32,309 charges or 35+ %, disability with 28,073, or 31% followed by sex discrimination at 29% and age discrimination at about 23%.

The lessons for private employers are obvious. Retaliation costs. Follow the law and don’t discriminate against those who suggest to you that you are not following the law. Every human resource department and most small business employers have a working knowledge of what they are permitted to do and what must not be done. It is normal to be defensive if someone points out your shortcomings in matters of employee hiring and treatment. It is stupid to be defensive to the point that you retaliate against the person bringing the problem to your attention. You are inviting two things, a claim with the EEOC, and a civil discrimination lawsuit. Additionally, the upset to your workplace could well be more costly than you can imagine, especially if the newspapers grab hold of the claim and make it front-page news.

After retaliation, the causes of discrimination are obvious. In this day and age discriminating on the basis of race, disability, sex, age or national origin usually must be prima facie evidence of stupidity or evidence of a real problem. Some cases are brought from malice or anger, but fewer of them end up costing the employer money. Defense lawyers are better, the law is more settled, and the facts must be clear.

EEOC has put a big push on using mediation to resolve charges voluntarily. The same report claims that the EEOC’s mediation program succeeds about 76% of the time, saving resources for employers, workers, and the agency.

One area that is growing is claims of discrimination based upon lesbian, gay, bisexual and transgender Karen LGBT) rights. For fiscal years from 2013 through 2016, about 4,000 LGBT individuals alleged sex discrimination and EEOC recovered $10.8 million for these claimants.

The 2016 claim settlements give fair warning to employers. Know the law, use common sense, and don’t let your emotions get in front of your judgment. If they do your wallet will also be a victim.

The Federal Reserve has raised interest rates and more raises are promised, translating into higher bond prices and higher mortgage interest rates. A new President will be sworn in on January 20th, and no one knows what budget or economic plan the new President and new Congress will disgorge. Wintertime is supposedly the worst time to sell a house. Shall I even look for a house? And if I am an owner, ven think of putting my house on the market?

Welcome to the vagaries of the real estate market. Add to the usual seasonality issues this year’s uncertainty as to interest rates and big picture economics. What is one to do? Look to the experts? This is a way to become really confused.

According to the National Association of Realtors, many large US housing markets, (think, San Francisco, Chicago, New York metro areas) need tens of thousands of housing units to meet current demographic demand. At the same time, Capital Economics Property Economist Matthew Pointon frets that the Trump wall(?) on the Mexican border would suck up labor and materials and worsen the housing ‘s already tight labor situation. Tight labor markets equal higher construction costs meaning more expensive housing at all levels.

HUD’s Location Affordability Index for the Greater Danbury area estimates that a family of four with a median income of $82,614 would spend about 30% of their current income to own a home with a 20% down payment, and another 18% for commutation expenses - the total ownership and work costs almost 50% of income. A renter would spend about 41% of income on the same basis. How do you interpret the numbers? Should I buy now and know that I’m spending a lot of my income for shelter? Or should I wait, and hope for price decreases over time? Interest rates have been at historic lows and still are very low. Is it silly to think that they will decrease again?

Often, the answer will lie outside economics. Do I have to move for a job? Do I need more space because of growing family? Am I downsizing because of age or other living concerns? Indications are that the home ownership costs are rising. Can I out wait the market? By the way, when will I want to sell? Where will the market be then?

We are back in the usual real estate conundrum. Real estate runs in cycles. Where am I on the cycle? There is an answer for everyone. You may not like your answer, but the other guy’s probably won’t help.

Whatever you decide as buyer or seller, make sure you use a real estate agent who knows what he or she is doing. Talk to your friends, especially real estate lawyer friends, your mortgage brokers and mortgage bankers, and make your decision based upon facts and knowledge not guesses and hopes.

As Christmas, both secular and religious, fills our minds, the New Year approaches with hope but also with a bit of trepidation. How did I do with last year’s resolutions? What am I planning for 2017? May I suggest that integrating your economic and family lives may be the best 2017 resolution?

You either work for yourself or for someone else. You have a spouse or children or you don’t. You have living parents and relatives or you don’t. You have assets and obligations or there is no sense reading further.

No matter an employee or an owner, married or single, kids or no kids, relatives and parents or not, we all have the same life facts. We, or those we know, will have health challenges at some point. We all will die, only the manner is a current mystery. We each want to have a say in our asset disposition and pay our obligations. In many cases, we would like to be remembered beyond our time on earth. The fact is, if we do not plan before events happen, someone else will raise our kids, care for our parents and relatives, or not, manage our business, and dispose of our assets in ways that may or may meet our wish.

The fact is, our economic lives and our personal lives are tightly intertwined. But if we do not know our assets, know our personal goals, and know how they can work together, we will be doomed to have troubled minds when we ponder the future.

If you work for a company you may have stock options, a 401k or other pension plan, life insurance, checking accounts, stock accounts, etc. The same if you own a business except that your principal asset may be your interest in your business, which may also be your principal pension asset. Perhaps the main assets in your life are not owned by you but are held by your spouse, parent or other relative. How we plan and use these assets in life will determine how they will be employed thereafter.

If you have stock options and a company pension plan, do you really know what happens if you keel over tomorrow? If you own a business, do you really know what happens if you or your partner(s) dies, have a falling out, become a drug addict or alcoholic, etc.? Honestly, do you really understand you LLC Operating Agreement? If a physical shows that you have heart issues, cancer etc., and you must cease working for a while, do you know what protects your family? If you and/or your spouse are in an auto accident, who guides your children if one or both of you are incapacitated? If you have a special needs family member, who takes care of him/her and with what assets?

This is why thinking first and treating your assets to meet your long term goals requires action now. If you say that you have a will, advance directive etc., have your circumstances or the law changed to affect your plan? Have you checked to see if your business documents, whether through an employer or your own company, meet your plan? We probably are able to help you quiet your mind by adding our knowledge to your goals. We understand and can integrate corporate and business law, real estate (your largest asset?) and estate planning. Give us a call (203) 733-0183. The initial 30 minute consultation is without charge.

Congress enacted the Fair Labor Standards Act (FSLA) in 1938. FSLA mandated employee overtime pay with certain exceptions, including for “any employee employed in a bona fide executive, administrative or executive capacity.” According to the Court, this is known as the “white collar” or “EAP” exemption.

Since 1949, in one form or another, the DOL has used a salary test to determine the definition of an EAP. The current minimum weekly salary level is $455 per week, $23,660 annually, to determine the EAP salary level. The new regulation, to take effect on December 1`, 2016, changed this level to $921 per week or $47,892 annually. Obviously, any employer having to pay overtime to those paid an amount lower that the new exemption minimum will see cists escalate dramatically.

Two cases, one brought by 21 States and the other by coalitions of businesses, had been combined for the purpose of this injunction hearing. Judge Mazzant first determined that a prior Supreme Court ruling finding that the FSLA applied to the States could not be overturned by him. Therefore, the States arguments that as applied by the DOL, the new FSLA rule would cause irreparable harm as the States would have to take millions from programs to pay overtime to those who would fall under the new rule due solely to the increased salary for the exemption.

The judge then examined the words of the FSLA as passed by Congress. In a nutshell, he found that “Congress intended the EAP exemption to depend on the employee’s duties rather than an employee’s salary.” Since the new rule determined that a salary level could be the sole determinant of exemption, that the rule did not meet the statutory standard so would likely fail after a full hearing. Since the rule applied nationwide and all States would be irreparably harmed the temporary injunction must also apply nationwide. Chaos would ensue if the rule went into effect in some states and not others.

This short blog highlights the Court’s conclusion but does not describe the full legal analysis or all the issue on the table. See this URL for the full opinion. http://www.nytimes.com/interactive/2016/11/22/business/document-U-S-Judge-s-Ruling-in-the-Overtime-C....

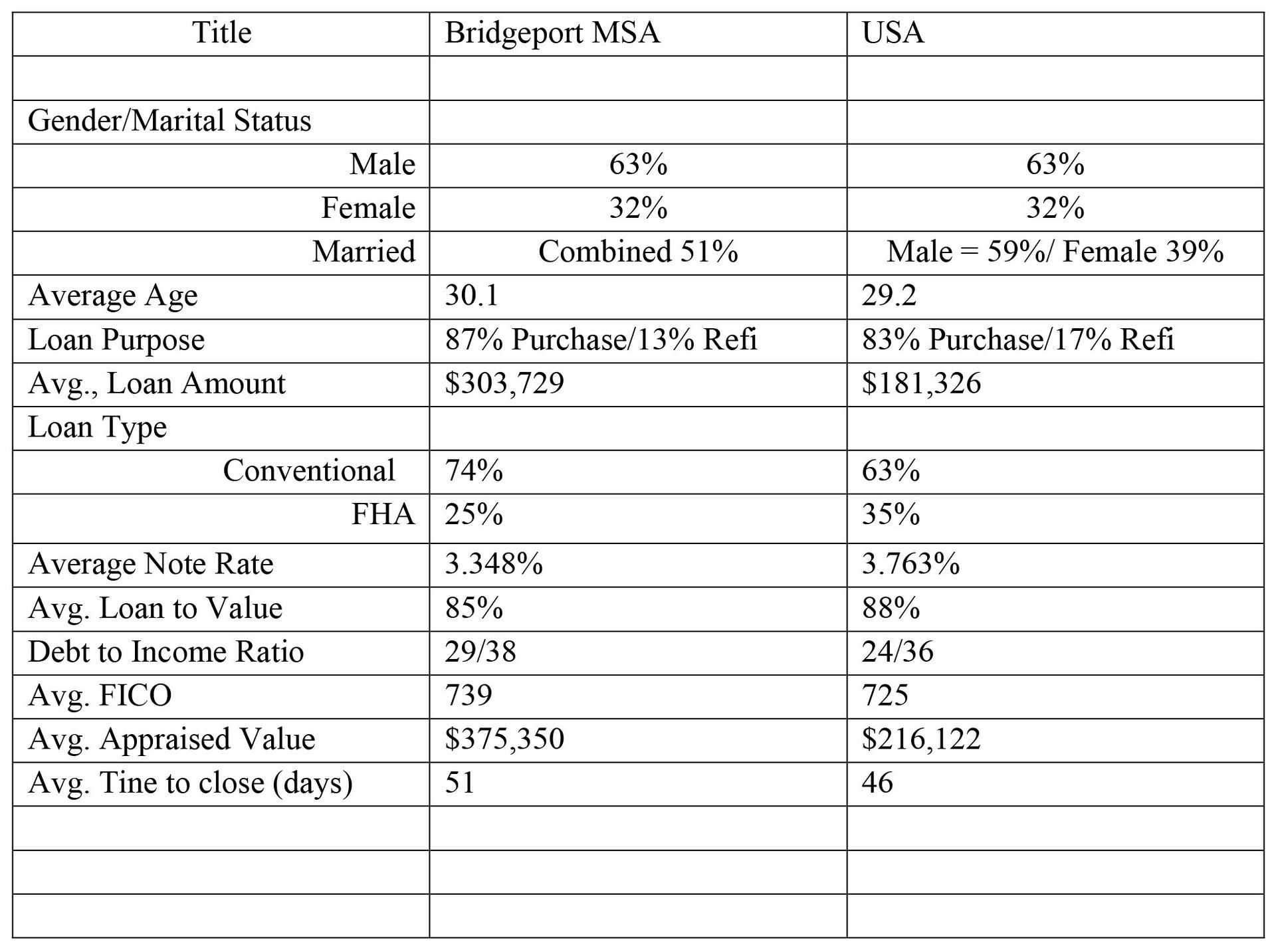

Millennials, those born between 1980 and 1999, have been a puzzlement to the real estate industry. Are they interested in buying a residences or are they content to rent forever? A new report by Ellie Mae® shows that the Millennials are active in the market, even the Fairfield County market. The total millennial cohort is estimated at 87 million persons. Their impact on the residential housing market is a given, with the only question being when and to what effect.

Ellie Mae® (NYSE:ELLI), a leading provider of innovative on-demand software solutions and services for the residential mortgage industry, recently issued its Ellie Mae Millennial Tracker™ , a new interactive online tool on millennial loan trends in the United States, The Tracker is broken down by Metropolitan Statistical Areas (MSA). Fairfield County is the Bridgeport-Stamford- Norwalk MSA, which includes the greater Danbury area. On a national basis, the Tracker examines about 75% of the closed mortgages. Unfortunately, the statistics do not break out the type of residence, that is, whether a single-family house or a condominium.

Millennials are definitely a factor in the Fairfield County residential housing market as they represented 27% of the mortgage loans closed in August in this MSA. However, this millennial percentage is a far cry from the average where in August 2016, millennials represented about 63% of the mortgage loans closed in the country.

In Fairfield County millennial males represented 63% of the borrowers and females 31%, with 6% “unspecified,” in line with the national averages. Married and single borrowers were roughly equivalent (51% - 48%). Nationally, 59% of male borrowers were married but 61% of female borrowers were single, a huge difference (no separate breakdown for the MSA). The average age of all Fairfield County millennial borrowers was 30.1 years while the national average was 29.2 years. So the Fairfield County millennial borrower is slightly older than his or her counterparts across the country.

Big differences in the Fairfield County millennial borrower versus national statistics shows up in the numbers surrounding the transactions. Nationally, the average loan amount for both conventional and FHA loans was $181,326, equal to 88% loan-to-value. The Fairfield County average loan amount was $303,729 and represented 85% loan-to-value. Therefore, in Fairfield County the loans to millennial’s required more equity from the borrower who signed a mortgage note equaling $122,403 more debt than the national average. Obviously the selling prices of Fairfield County residences far exceed the average costs in the country with the Fairfield County appraised value of $375,750 equivalent to 57% more than the $216,122 average appraised value in the nation.

Even the loan types are different in Fairfield County where 74% of the loans were conventional and 25% or FHA. Nationally, conventional loans represented 63% and FHA loans 35% of the mortgages.

In the nation the average FICO score in August was 725 while the Fairfield County average score was 738. The Fairfield County time to close is a somewhat alarming statistic. The time to close on a national basis was 45 to 46 days while in Fairfield County Fairfield County it took 51 days representing more than an extra week of business days to close the mortgage and take title to the residence.

In sum, millennials are currently a factor in the marketplace that can only grow in importance. The millennial cohort is estimated to number about 87 million so the sheer volume of folks entering the market each year will impact the residential home market. It will be most interesting to see what types of residences they buy and if their numbers are sufficient to sop up existing homes as retirees leave Fairfield County for lower-cost living elsewhere.

The table below compares the Bridgeport MSA with the nation as a whole.Judge Andrew S. Hanen of the U.S. District Court for the Southern District of Texas, issued an injunction on February 16, 2015 preventing the Secretary of Homeland Security from putting into effect the provisions of the Deferred Action for Parents of Americans and Lawful Permanent Residents Act (DAPA), In summary, his decision says that while an executive agency has discretion to decide the manner of enforcing laws, it does not have the ability to abdicate its duty to enforce laws or to make laws as this is Congress' domain. Therefore, while deciding how and when to prosecute individuals under the United States laws impacting pesons not legally in the United states, granting them benefits such as the right to driver's license and social security cards, is making law and prohibited without an Act of Congress.

At the risk of enraging lawyers by not dissecting Judge Hanen's well reasoned (my opinion) legal analysis, here are the major points.

- The State of Texas and the other 25 plaintiff states have standing to bring the lawsuit. Texas proved that taking the steps required by DAPA and other relevant federal laws to grant driver's licenses to the four million (government's number) illegals would cost them millions of dollars. Therefore, the harm is real and immediate.

- DAPA and the actions under it are not the result of any law passed by Congress nor even an Executive Order from President Obama, but rest solely on the actions of the Secretary of Department of Homeland Security Jeh Johnson, contained in what the Court calls the DAPA Memorandum.

- The right to grant benefits to non-legals such as drivers' licenses and social security cards is not an exercise in prosecutorial discretion but grant of rights not given in any law, therefore, lawmaking. The judge cited the Department of Immigration's Citizenship booklet specifically using the grant of a driver's license as an example of reserved state power.

- While a federal agency may decide how to enforce a law, it cannot abdicate its obligation to enforce laws, even those it does not like. The judge has a long discussion of "agency enforcement discretion" but concludes that in this cae, DHS is abdicating its reponsiblity to enforce the immigration laws, at least as it pertains to the four million non-legals estimated to be impacted by DAPA.

- DAPA should have been subject to the Federal Administrative Procedure Act with its requirements of public notice and hearing. This was not done.

- Legal consequences that would not be reversed easily would flow from allowing the DAPA to become effective on February 18, 2015. Therefore, the harm to Texas and other states would be irreparable so preliminary injunction applies.

I have not done justice to Judge Hanen's well reasoned and carefully thought out decision on multiple legal issues. He especially hits all the arguments that Texas has no standing to sue. A decision on standing moots analysis of the substantive issues so it would be the hope of the government that winning on this issue leaves them a path to proceed with granting the DAPA benefits. However, I believe this summation gives the essence of the opinion.

The President and Attorney General have already stated that they will immediately appeal this decision to the 5th Circuit Court of Appeals, seated in New Orleans. The pundits are saying that the ruling will be overturned by the 5th Circuit. .This lawyer's opinion says that Judge Hanen's decision is thorough, well reasoned and well researched. The Court of Appeals will be hard pressed to overturn the reasoning. No matter what the outcome, the U.S. Supreme Court will decide this case ultimately because the issues are so important.

A friendly service of AJ Mannion Law Office LLC

Today the U.S. Court of Appeals for the Second Circuit released an opinion bringing sanity to the world of insider training. In a rebuke to the Federal prosecutors' push to criminalize trading by someone who did not realize that he was trading on an insider's tip and did not reward his tipper. The court dismissed with prejudice the convictions of two portfolio managers whom a jury had convicted of insider trading.

In the case, the court stated:

The Government alleged that a cohort of analysts at various hedge funds and investment firms obtained material, nonpublic information from employees of publicly traded technology companies, shared it amongst each other, and subsequently passed this information to the portfolio managers at their respective companies. The Government charged Newman, a portfolio manager at Diamondback Capital Management, LLC (“Diamondback”), and Chiasson, a portfolio manager at Level Global Investors, L.P. (“Level Global”), with willfully participating in this insider trading scheme by trading in securities based on the inside information illicitly obtained by this group of analysts. On appeal, Newman and Chiasson challenge the sufficiency of the evidence as to several elements of the offense, and further argue that the district court erred in failing to instruct the jury that it must find that a tippee knew that the insider disclosed confidential information in exchange for a personal benefit.

We agree that the jury instruction was erroneous because we conclude that, in order to sustain a conviction for insider trading, the Government must prove beyond a reasonable doubt that the tippee knew that an insider disclosed confidential information and that he did so in exchange for a personal benefit. Moreover, we hold that the evidence was insufficient to sustain a guilty verdict against Newman and Chiasson for two reasons. First , the Government’s evidence of any personal benefit received by the alleged insiders was insufficient to establish the tipper liability from which defendants’ purported tippee liability would derive. Second , even assuming that the scant evidence offered on the issue of personal benefit was sufficient, which we conclude it was not, the Government presented no evidence that Newman and Chiasson knew that they were trading on information obtained from insiders in violation of those insiders’ fiduciary duties.

Accordingly, we reverse the convictions of Newman and Chiasson on all counts and remand with instructions to dismiss the indictment as it pertains to them with prejudice.

I suspect that the US Attorney may appeal this case to the Supreme Court as it changes the notion of crimina; ization of insider trading.

What does this mean to you? If Aunt Tilly calls with a stock tip that she says she got from a friend and thought that she would give up a heads up because you need the money from a good trade, you bank your profits and smile. If the same Aunt Tilly tells you that she has a "special friend" who is on the Board of Directors of a company and she has a hot tip after pillow talk, hang up. If she further states, that she would like to share the bounty after you profit, do not stop, go to jail directly. If you know that the information is not public and you pay the tippee, you will disgorge profits and probably go to jail.

However, if you just trade on rumor, no criminal act.

Brought to you as a service of the AJ Mannion Law Office LLC

| A friend of mine recently came to me a bit upset. A car had hit his daughter while she was crossing the street at a crosswalk The driver kept going. His daughter was seriously injured. So seriously that the emergency room doctors said if she had arrived five minutes later she probably would have died. As it is, she will undergo a long period of rehabilitation. He came to me because he, the grandfather, realized that there was absolutely no documentation in the family stating who would raise his granddaughter on the mother's demise. As with many modern families, the parents are divorced. Circumstances are such that the father would probably not want to raise the daughters within his second family. The possibility of having to fight through the probate court to bring the daughter under his roof, even though she and her mother had been living with the grandparents, was a fearful prospect to him. This is a real case and brings home how ill prepared for adversity most of us are. The mother and daughter were young and healthy. In microseconds, an accident changed their life for good. It could happen to anyone. Heart attacks, cancer, other diseases, accidents, change in economic circumstances; all can and do happen to folks like you each and every day. Think ahead while you have the time. Who will take care of your children if you die, if you and your spouse die in the same accident? Do you have disability insurance that could pay the mortgage and buy groceries if you are hit by a car, or disabled by disease, or in rehab for an extended period? According to the Census Bureau, over 14 million folks, approximately 6% of the population between 16 and 64, have a disability that makes it hard or impossible to work. Reality sucks at times, but it hurts less if you are prepared. As opposed to fighting in court after something happens, using a lawyer in the planning phase is inexpensive. The very last thing you want is to have DSS take care of your children. Plan now, please. Brought to you as a service of the AJ Mannion Law Office LLC |

| |

Former New York Mayor Giuliani's law firm, Bracewell and Giuliani, has brought attention to a recent Securities and Exchange Commission settlement with a former mayor and city administrator of the City of Allen Park, Michigan for materially false and misleading statements in bond offering documents. This appears to be the first time that a political officer, the mayor, was determined to be a "controlling person" under section 20(a) of the Exchange Act of 1934. This was even though the Mayor did not review the documents or take part in drafting them.

The offering documents did not mention that a Private Public Partnership to develop a major studio project with a Hollywood producer had hit the skids and would not happen. The project was supposed to be an economic development driver for the City.

The mayor was charged under Section 20(a) of the Exchange Act that "provides joint and several control person liability against individuals with authority to oversee and direct individuals involved with securities offerings."

What does this mean of municipal officials? It means that mayors, council members, city administrators and other officials that can be determined to "control" those individuals who write the documents may be found liable if bond documents contain material misstatements or omissions to state material facts. No longer will ignorance be bliss. This is a warning to municipal officials to read and understand bond offering documents. Do not be afraid to ask hard questions based on your personal knowledge. In case of doubt, demand changes. Err on the side of disclosure. Don't take the chance that you may be found personally liable for misstatements in a multi-million dollar offering.

Brought to you as a service of the AJ Mannion Law Office LLC

On Monday, Sept. 22, 2014 the Wall Street Journal's Wealth Management section featured an article entitled "Time for the Estate Talk." It is available on the Journal's web site. For those who do not subscribe, I am going to summarize the article below.

Talk of the hereafter and honesty about family finances are usually not in the forefront of family discussions. Often due to reticence, personality conflicts, or just privacy, the talk about what parents will leave children never takes place. Any lawyer or financial advisor practicing in the area will suggest that this is not a good thing. The WSJ article gives good reasons to have the talk with the potential heirs.

1. You'll have a chance to smooth ruffled feathers. There are many opportunities for resentment after hearing the contents of a will. During the "talk" the parents can explain why they are doing what they are doing. For example if one child is in a profession that doesn't pay as well as another, the parents may explain the reasons for leaving more to the artist than to a richer sibling in a way that avoids resentment.

2. You will save them hassles and mistakes. Ignorance may be bliss but not when grieving and trying to find a parent's assets at the same time. Legal and financial issues occurring due to death or disability can add stress to what is usually a tough emotional landscape. Knowing the parent's financial advisors and attorneys can avoid some of this.

3. You may increase their quality of life now. The article cites an instance where a parent slowly built to business to be worth $ millions. The adult child had gone through many economic struggles and could have used a little practical assistance during life. Told that she would inherit millions on their death, the child was a bundle of emotions as to why her parents let her struggle so much and undergo such, to her, unnecessary emotional upset. The "talk" could have allowed a discussion as to whether this was the better way for the family.

4. The children might give you better ideas. The article uses the example of a vacation house that the parents, worried about the ownership cost for the kids, wanted the trust to state that if not used 125 days a year, the house should be sold. The kids knew that this was a high hurdle given their busy lives. Due to the discussion, the family reached a solution amenable to all.

5. You may save them some taxes. Taxes can be a burden. If the children are sufficiently wealthy, the inheritance may cost them a lot. Coordinating tax planning in the family can help a lot. Without the "talk" no one will know.

In sum, having the "talk" is good for any family. Whether the assets are large or small. Don't leave the kids wondering if you loved one less than the other because of your will. Keep your heirs apprised of the location of your documents and your advisors. It is especially helpful if you become disabled. Unfortunately, we all believe that we control life, but in reality, life controls us. Act accordingly.

Brought to you as a service of the AJ Mannion Law Office LLC